2021-2022 Proposed Budget

King County provides critical local and regional services to millions of people, with a two-year budget of about $15.9 billion, 16,700 employees, and more than 60 different services.

Next steps

Executive Dow Constantine transmitted his budget to the King County Council on Tuesday, Sept. 22. Follow the Council's budget process here.

Resources

2021 Quarterly Budget Reports

2020 Quarterly Budget Reports

Overview

King County is facing an unprecedented budget shortfall in 2021-2022. The COVID-19 pandemic and resulting economic recession have led to sharp declines in sales tax revenues, creating significant gaps in many funds, including Metro Transit, the General Fund, and the Mental Illness and Drug Dependency Fund.

The 2021-2022 Proposed Budget focuses on balancing the budget while maintaining vital services for residents, continuing progress on critical priorities such as the environment, and advancing the County’s anti-racism agenda, including intentional and meaningful community engagement. This was accomplished through:

- Cost and service reductions in General Fund agencies and internal services.

- The prudent use of reserves, which the County has been building over the last decade.

- New revenue, including rent payments for the use of the right of way by utility franchises in unincorporated King County.

- Investments in new approaches in the criminal legal system that will allow for divestments in the future.

- Effective human resources management, including the use of the Voluntary Separation Program, to reduce layoffs as much as possible.

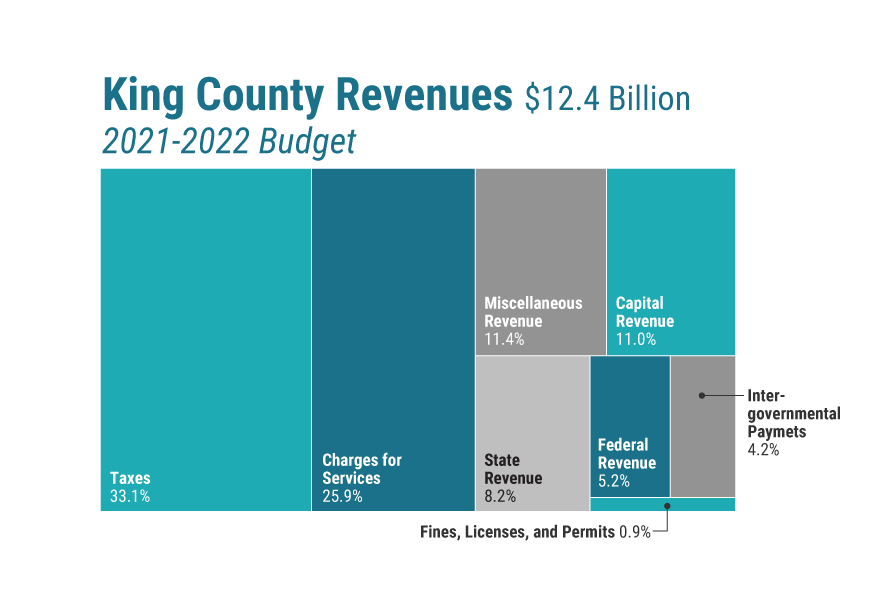

Revenues

- 2021-2022 Budget: $12.4 billion

- Taxes: 33.1%

- Charges for services: 25.9%

- Miscellaneous revenue: 11.4%

- Capital revenue: 11%

- State revenue: 8.2%

- Federal revenue: 5.2%

- Inter-governmental payments: 4.2%

- Fines, Licenses, and Permits: 0.9%

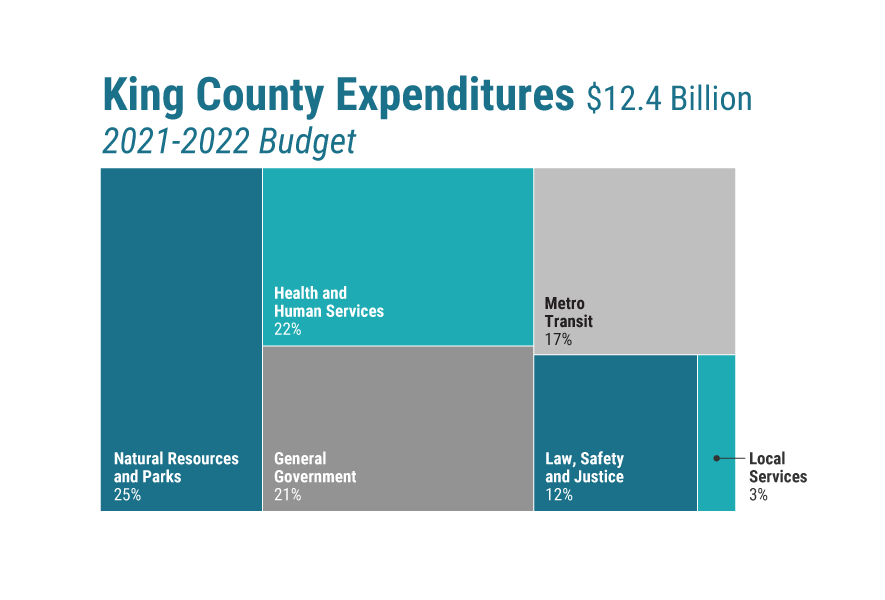

Expenditures

- 2021-2022 Budget expenditures: $12.4 billion

- Natural Resources and Parks: 25%

- Health and Human Services: 22%

- General Government: 21%

- Metro Transit: 17%

- Law, Safety and Justice: 12%

- Local Services: 3%

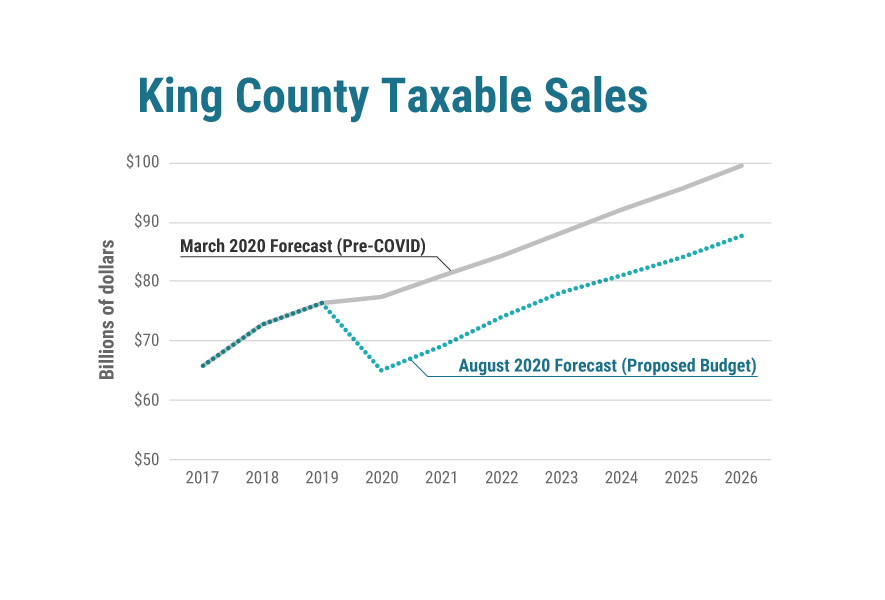

Taxable Sales

A graph shows expected taxable sales in King County from 2017 through 2026. The March 2020 Forecast (Pre-COVID) estimated taxable sales in King County of less than $80 million in 2020, and about $80 million in 2021, increasing to nearly $100 million by 2026. The August 2020 Forecast (Proposed Budget) estimates King County taxable sales of approximately $65 million in 2020, and less than $70 million in 2021, rising to less than $90 million by 2026.

Budget Highlights

The 2021-2022 Proposed Budget includes investments that begin to address the crisis of racism, including:

- Criminal legal system reform.

- Developing and implementing alternative public safety models.

- Co-creating solutions with the community.

- Supporting the long-term sustainability of community-based organizations.

- Supporting Black, Indigenous, and people of color (BIPOC) employees.

These efforts are part of a long-term strategy that will—over multiple budget cycles—redeploy resources from downstream responses to upstream programs that will continue to shift the County’s focus from a system of criminal justice to one of racial and social justice.

Climate change is one of the paramount environmental and economic challenges for our generation. The 2021-2022 Proposed Budget takes actions that will preserve and restore our natural environment, help residents and businesses adapt, and lead the way to an equitable clean energy economy. King County’s environmental priorities include:

- Achieving healthy water quality and habitat.

- Preserving, creating, and maintaining equitable green spaces and resilient natural systems.

- Creating a clean energy economy with career pathways for historically oppressed communities and transitioning our built environment for a climate friendly future.

- Accelerating the transformation of waste management toward zero waste of resources.

The landscape in which Metro Transit operates changed drastically when the COVID pandemic led to significant declines in revenue and ridership. Metro’s 2021-2022 Proposed Budget focuses on restoring and rebuilding the mobility system, including:

- Ensuring access to mobility for essential workers and transit-dependent riders during the COVID-19 pandemic and implementing a recovery strategy as riders begin returning to transit.

- Continuing to invest in a 100 percent zero-emission fleet.

- Working with the community to envision new models for fare enforcement and policing.

- Rolling out the subsidized annual pass program.

- Delaying fare increases and their impact on riders and ridership until 2023.

- Updating policies consistent with the Mobility Framework.

Building on lessons learned with the COVID-19 homeless response, the 2021-2022 Proposed Budget takes concrete steps to address homelessness by:

- Making significant short- and long-term impacts on homelessness.

- Increasing access to housing.

- Accelerating the development of affordable housing.

- Improving the regional coordination of homeless crisis response through the continued implementation of the new King County Regional Homelessness Authority.

Behavioral health services are in high demand, particularly given the health and emotional impacts of COVID-19. At the same time, King County is facing a funding crisis for behavioral health services due to stagnant state revenues and increasing costs, especially those related to Involuntary Treatment Act (ITA) court. In 2021-2022, King County can no longer afford to fund many of the programs that stabilize non-Medicaid clients and reduce impacts to the much more expensive crisis system. Absent another funding source or state legislative action, deep cuts to non-Medicaid funded programs will be necessary beginning in 2022. Executive Constantine is proposing a new revenue source to address this gap and also provide funds for permanent supportive housing, which combines housing with services needed by the individuals who live there.

In addition, due to COVID-19 reductions in economic activity and the related recessionary impacts on sales tax revenues, the Mental Illness and Drug Dependency (MIDD) Fund projected revenues dropped precipitously for the three-year period 2020-2022. This fact sheet outlines the process, approach, and proposals to address the 2021-2022 financial gap in the MIDD.

In an effort to reduce costs while preserving services and jobs, Executive Constantine is proposing to consolidate downtown office space in the 2021-2022 budget, including closing the Administration Building and co-locating a number of customer-facing services at King Street Center.

Consolidating King County’s footprint into fewer buildings will:

- Lower utility, building maintenance, and lease costs.

- Make it easier for residents to access a variety of County services.

- Reduce the County’s carbon footprint.

- Support the desire of many employees to continue teleworking after the pandemic.

King County is the local service provider for roughly 250,000 people in the unincorporated areas. The Department of Local Services, along with other County agencies, is prioritizing community-driven input into the biennial budgeting process by expanding community participation and decision-making to improve the services, programs, and facilities provided by the County.

Key proposed investments in 2021-2022 include:

- Diverting marijuana retail sales tax funding from the Sheriff’s budget to ensure that more tax revenue from marijuana retail sales is reinvested in the communities where the stores are located.

- Two new capital projects to support community needs through a participatory budgeting process, including exploring options for a community center in Skyway.

- Continued funding for a position to support the Green Building Program to improve building efficiency, reduce water use, and reduce construction waste.

- More than $20 million in funding for the conservation of open space.

Even before Public Health - Seattle & King County set up an emergency action center to respond to the COVID-19 outbreak in January 2020, King County was preparing for the pandemic. In the following months, King County took unprecedented actions to mobilize a regional response to fight the disease. However, without additional federal or state funding, many of these programs will end in early 2021.

Intentional and meaningful community engagement and co-creation is foundational to King County’s success in being pro-equity, living its value of leading with racial justice, and effectively addressing racism as a public health crisis. The 2021-2022 Proposed Budget makes investments to change the County’s approach to working with the community to support co-creation and the long-term success of community-based organizations.

General Fund

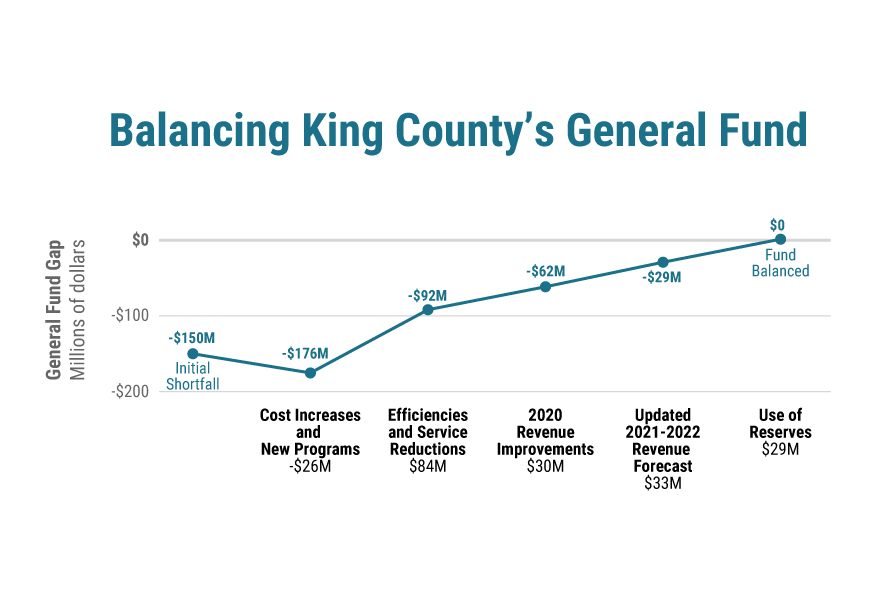

The King County General Fund supports the traditional functions of a county government, most of which are required by state law. In June 2020, the General Fund had a projected gap of $150 million for 2021-2022.

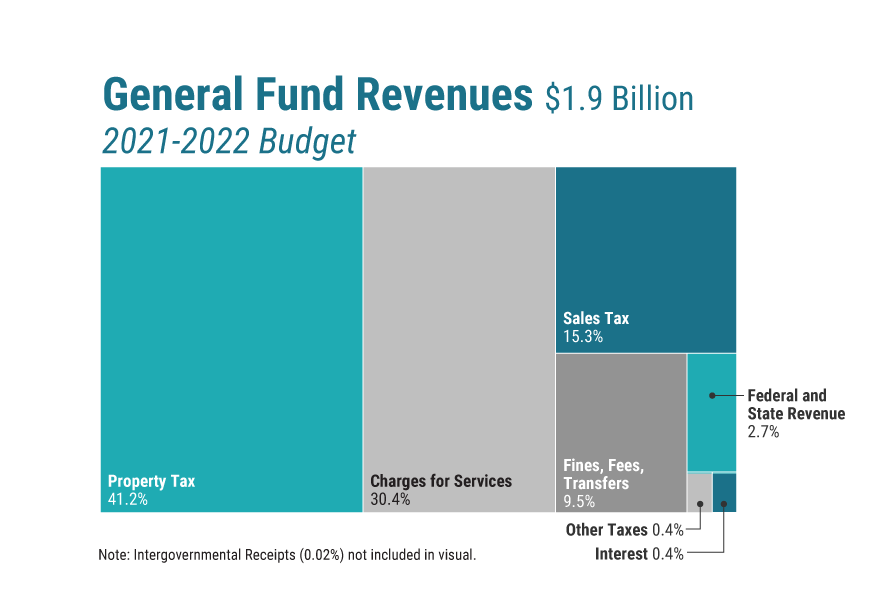

General Fund Revenues

- 2021-2022 Budget General Fund revenues: $1.9 billion

- Property tax: 41.2%

- Charges for services: 30.4%

- Sales tax: 15.3%

- Fines, Fees, Transfers: 9.5%

- Federal and State revenue: 2.7%

- Other taxes: 0.4%

- Interest: 0.4%

- Intergovernmental Receipts: 0.02%

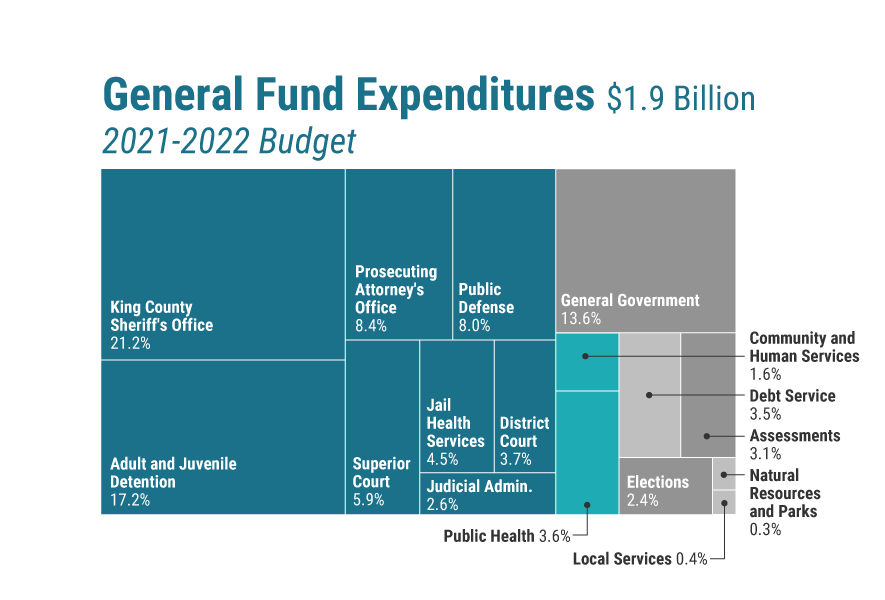

General Fund Expenditures

- 2021-2022 Budget General Fund expenditures: $1.9 billion

- King County Sheriff's Office: 21.2%

- Adult and Juvenile Detention: 17.2%

- Prosecuting Attorney's Office: 8.4%

- Public Defense: 8%

- Superior Court: 5.9%

- Jail Health Services: 4.5%

- District Court: 3.7%

- Judicial Administration: 2.6%

- General Government: 13.6%

- Community and Human Services: 1.6%

- Public Health: 3.6%

- Debt Service: 3.5%

- Assessments: 3.1%

- Elections: 2.4%

- Natural Resources and Parks: 0.3%

- Local Services: 0.4%

Path to General Fund Balancing

This chart shows an initial shortfall of $150 billion. Cost increases and new programs increase the shortfall by $26 million, to $176 million. Efficiences and service reductions reduce the shortfall by $84 million, to $92 million. 2020 revenue improvements reduce the shortfall by $30 million, to $62 million. Updated 2021-2022 revenue forecast reduces the shortfall by $33 million, to $29 million. Using $29 million in reserves balances the budget.

Translate

Translate