2022 taxes

Your property taxes: Expect modest increases this year despite rising values

The increase will be about 3% for the 2022 tax year. Property values rose by about 9% last year.

By the numbers

- Collections for this year are $6.79 billion, an increase of $190 million from 2021.

- Total county property values increased to $722.5 billion from $659.5 billion.

State law requires us to set values on January 1 of each year. We base the taxes collected in 2022 on the value of your property on January 1, 2021.

Why do my property taxes increase?

Voter-approved levies are the main reason. According to King County Assessor John Wilson, “Local governments may only increase collections by 1% per year without a vote of the people. Voter-approved levies aren't subject to that restriction.”

King County Treasury began sending out property tax bills on February 15, 2022. The first half of this year's taxes were due May 2. The remainder are due by October 31.

Your property taxes will vary depending on several factors:

- Location

- The assessed value of the property

- How many jurisdictions (state, county, city, school or fire district, etc.) levy taxes

See property tax bills and residential median values by city.

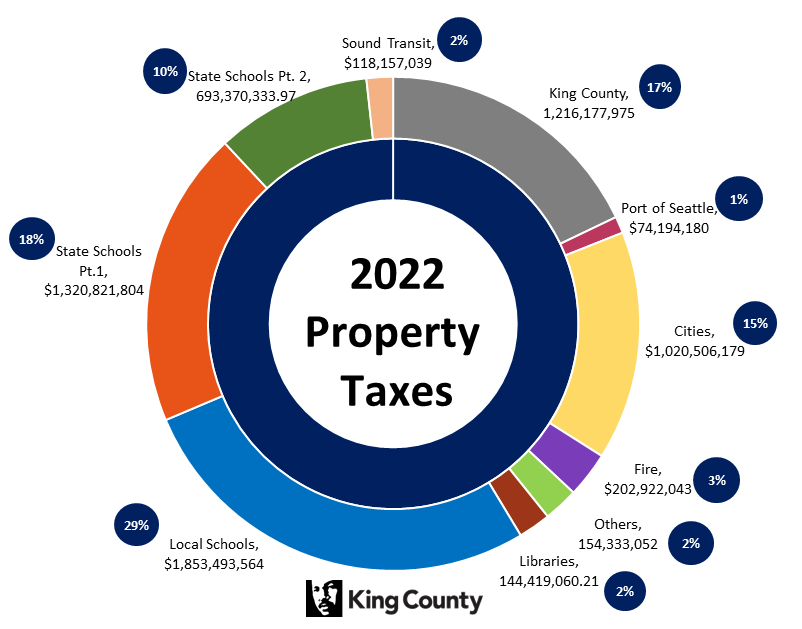

Where do my property tax dollars go?

We collect taxes for the state, the county, cities, and taxing districts like schools. Then we distribute the revenue back to them. Taxes also fund voter-approved measures for veterans, seniors, fire protection, and parks.

King County gets about 17% of your tax to fund services like roads, police, and public health.

Here's how it breaks down:

Important dates

- May 2: First half of property taxes due (If taxes are less than $50, full payment is due.)

- May 2: Personal property listing forms due

- June 1: Penalty of 3% assessed on delinquent taxes

- July 1: Appeals to the County Board of Equalization due

- September 1: Applications for limited-income deferrals due

- October 31: Second half of property taxes due

- December 1: Penalty of 8% assessed on delinquent taxes

Translate

Translate