King County Property Tax

_________________________________________________________________________________________________________________________________________

Property Tax

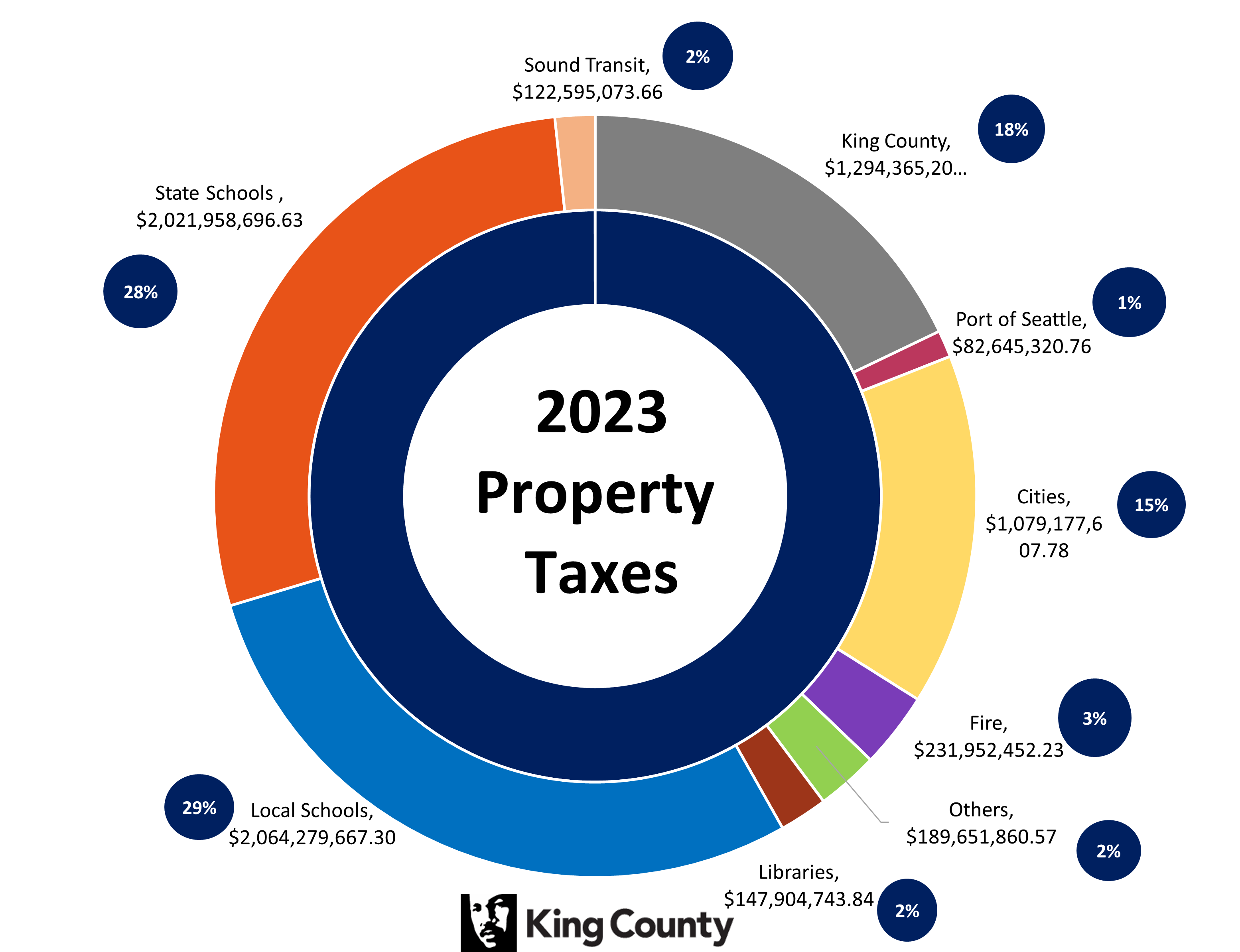

Property taxes are a major source of funding for King County. More than half of the revenue levied from property taxes is directed to our state and local schools to fund education. King County's 39 cities, Sound Transit, the Port of Seattle, and the Library systems also receive funding from property taxes. The portion King County receives (~$1.2B in 2022) funds numerous services such as criminal justice programs, roads and transportation, elections and general government, parks, and emergency services.

_________________________________________________________________________________________________________________________________________

Source: King County Assessor's Office

_________________________________________________________________________________________________________________________________________

Assessed Value, Historical Levies, and Levy Rates

The King County Assessor's office maintains a detailed online database of assessed value and property tax distributions. Much of this data is summarized into easily access reports on their website. Using this data, we compiled a spreadsheet that contains the King County historical levy rate and levy amounts from 1991-2023.

_________________________________________________________________________________________________________________________________________

Translate

Translate