King County Sales Tax

_________________________________________________________________________________________________________________________________________

Sales tax

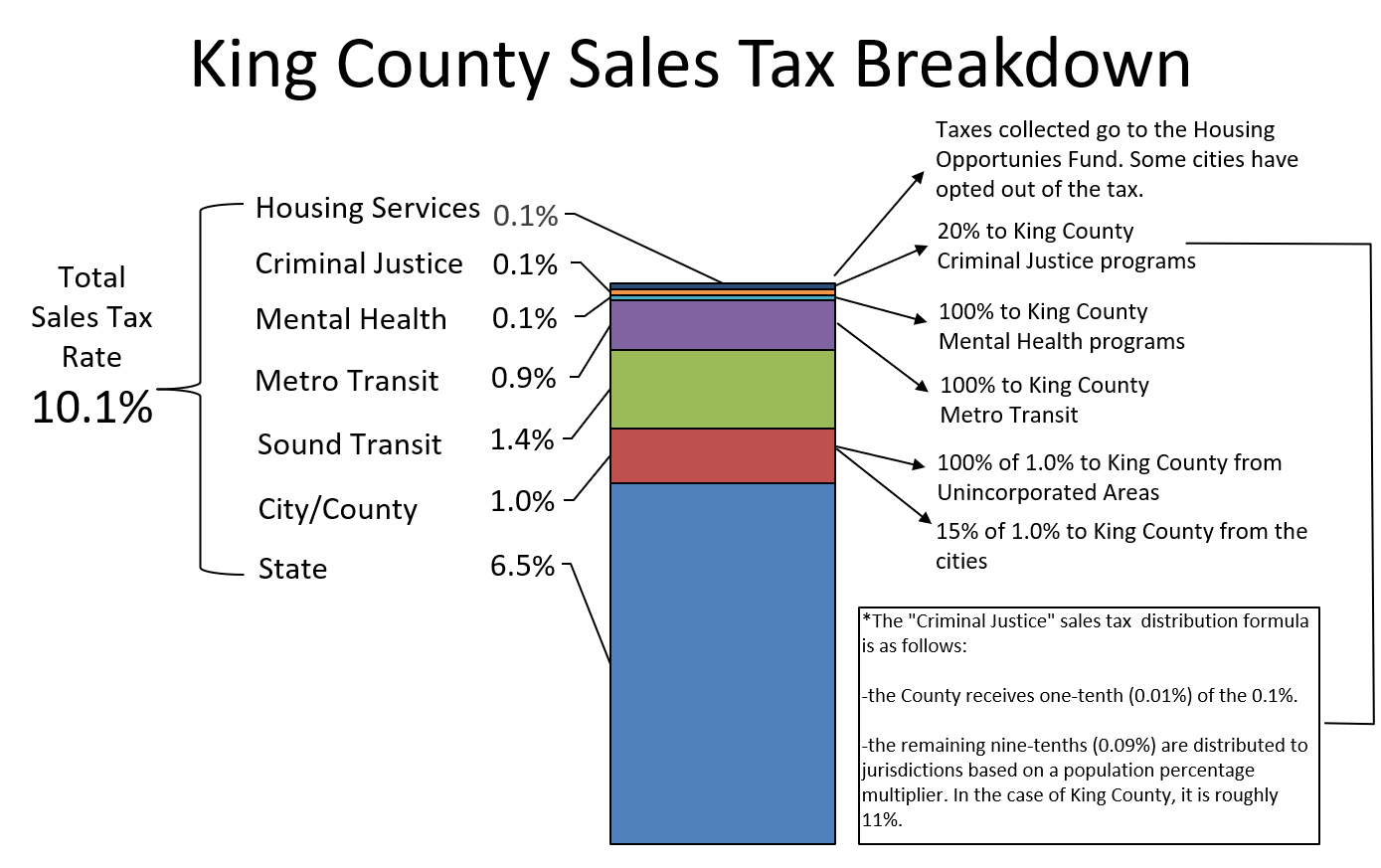

On January 1st, 2021 the retail sales tax in King County was raised to 10.1% in most cities. The bulk of this revenue goes to the state and our Regional Transit Authority (RTA = Sound Transit). The remaining portions that King County receives fund metro transit, criminal justice programs, mental health programs, children and family service programs, housing programs, and general government operations. While 10.1% is the rate most folks pay in King County, there are areas outside the RTA zone that pay a lower rate. In addition, there are a few cities who may charge a slightly higher rate if they've levied a citywide sales tax of some kind. The state DOR tracks all tax rates at the city level here.

_________________________________________________________________________________________________________________________________________

_________________________________________________________________________________________________________________________________________

Taxable sales

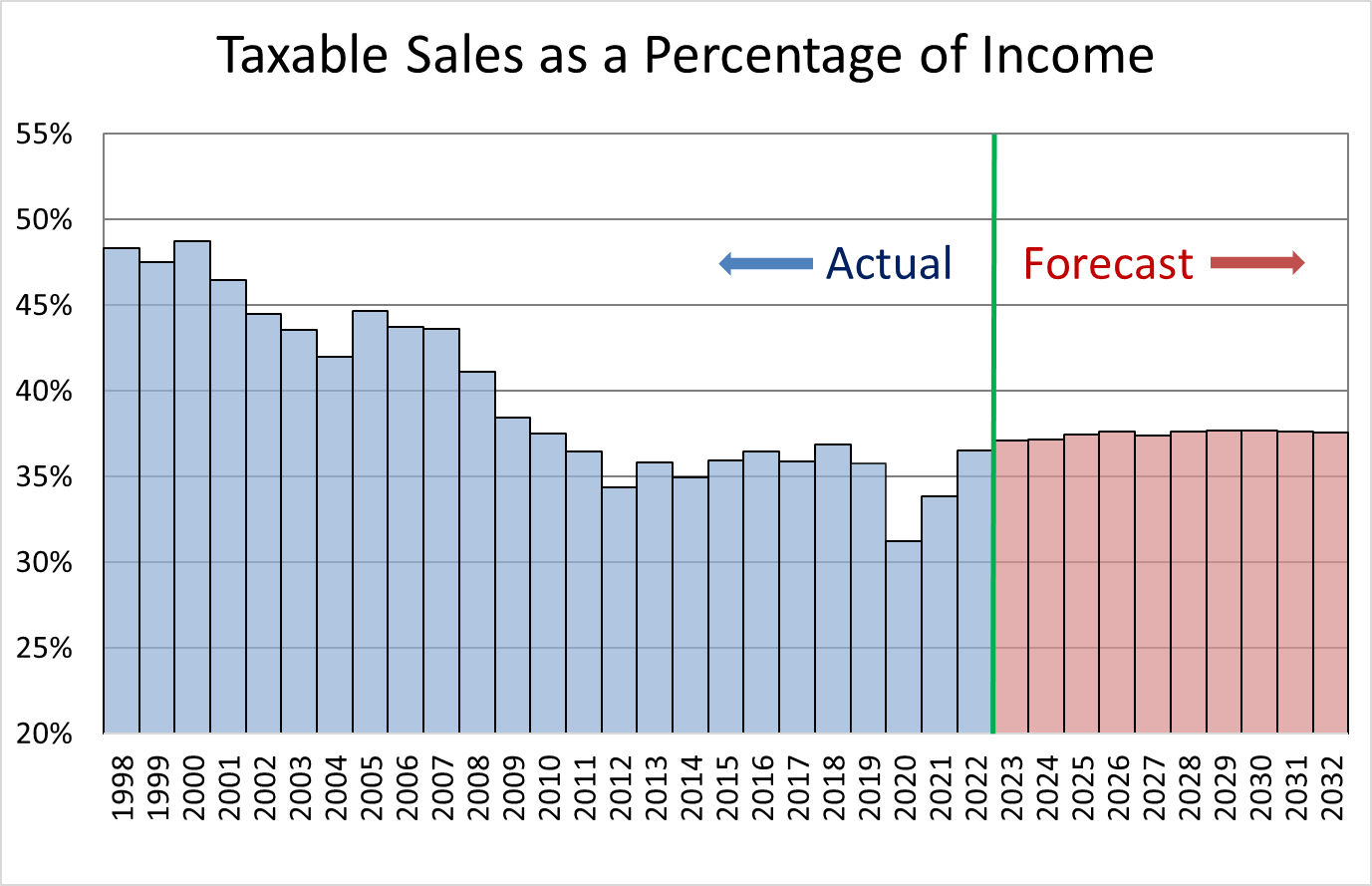

The Washington State DOR maintains a detailed and useful online database of taxable sales and sales tax distributions. Using this data, we compiled a spreadsheet that contains the annual taxable sales for each city (and the unincorporated area) from 2009 to 2022. Click here to access the excel workbook. Below is a chart depicting taxable sales as a percentage of personal income in King County. Taxable sales have not kept pace with rising incomes, which shows one of the major shortcomings of sales tax as a revenue tool.

_________________________________________________________________________________________________________________________________________

Translate

Translate