About the Budget

Understanding the King County Budget

The biennial county budget is the single most important document through which the King County Council sets policy for county government and oversees the delivery of services you need and expect. This “big picture” look will help you understand how the King County budget works.

The budget process begins with County Executive submitting his proposed budget to the King County Council in late September. The Council then holds a series of public hearings and panel meetings to scrutinize the proposal and develop its own. The Council traditionally adopts the final county budget before Thanksgiving.

Restricted and unrestricted funds

The county budget is composed of two types of funds: dedicated funds and the General Fund. Dedicated funds are the largest portion of the county budget, at about 86% of the total budget. These funds include contracts for services, fees, and levies that have been collected for specific purposes and must be allocated by law toward those purposes. For example, bus fares must go towards paying for transit, sewer fees towards paying for wastewater treatment, and the voter-approved EMS property tax levy to funding Emergency Medical Services.

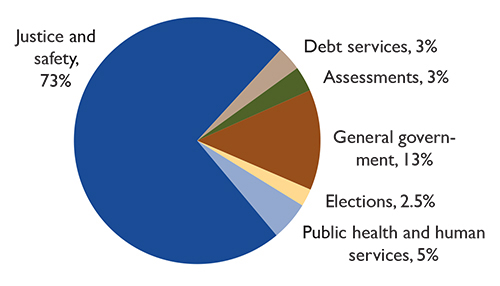

There is more flexibility in the General Fund, which is about 14% of the total budget. This fund pays for the traditional functions of county government, such as the Sheriff's office, and critical day-to-day services that are not supported by dedicated revenues. Almost three quarters of the general fund (73%) goes to support state-mandated criminal justice and public safety services. The remainder pays for other programs, such as health and human services (see pie chart below).

King County General Fund expenditures

Funding the services you receive

The General Fund and the many services it provides to county residents is supported by two principal sources of tax revenue: property tax and sales tax.

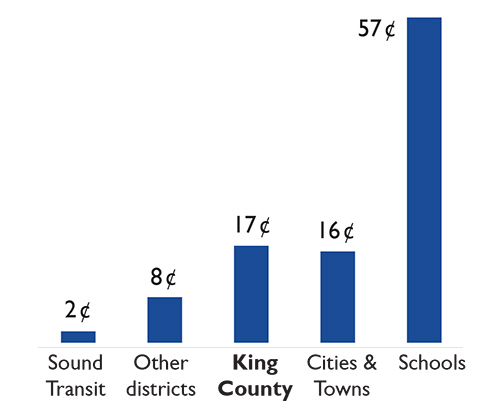

King County is the property tax collector for all taxing districts within the county. Although you pay your property tax to King County, the County receives only 17 cents of every dollar. The rest goes to other agencies, including 57 cents to schools, 16 cents to cities and towns, and 10 cents to other taxing districts (see graph below).

Where your property tax dollar goes

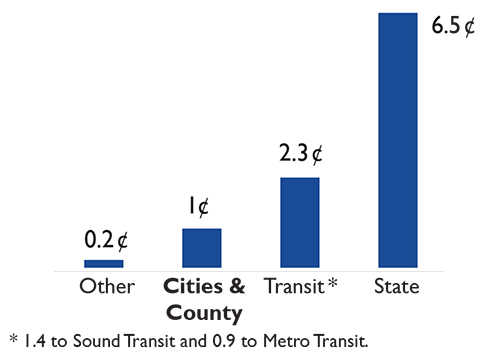

King County residents pay an average sales tax of 10 percent. The state keeps 6.5 percent; 1.4 percent goes to Sound Transit and 0.9 to Metro Transit; 0.2 percent is set aside for criminal justice, and mental health and substance abuse services; and the remaining 1 percent is split between cities and the County. (See graph below.)

Where your sales tax goes

Structural gap, or why is there a budget shortfall?

King County is now the 13th most populous county in the nation, with about two million residents, and King County government is the second largest provider of public services in Washington State.

In addition to the services they usually provides to residents, counties have had to fill the gap as federal and state governments have made significant reductions to their support of vital human services and left other critical needs unfunded. These service responsibilities have come without additional funding from the state or other sources to meet the expenses they incur.

Annexations and incorporations have also reduced King County’s tax base, as previously unincorporated areas now send their tax revenues to cities.

Counties have only two principal sources of tax revenue to support public services—property tax and sales tax. In contrast, the State of Washington and cities have more revenue sources, such as business and occupancy taxes and utility taxes, in addition to property tax and sales tax revenues.

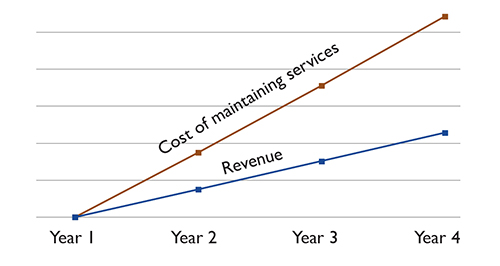

By voter initiative in 2001, subsequently passed into law by the Washington State Legislature, the amount of property taxes levied by counties can increase by only 1 percent per year, plus revenue from new construction. As a result, revenues counties receive grow at a much lower rate than the cost of maintaining services to residents. This gap is called the “structural gap.”

The chart below illustrates how this structural gap creates an ever widening deficit between the cost of maintaining the same level of services and the lowered revenue the county receives. In years with a recession, this gap widens further, as revenues remain flat or decrease. The insidious result of the structural gap is that King County becomes unable to provide the same level of services as in the previous year, requiring continuous cuts to essential services to residents.

King County is not alone in this situation. Counties across the Washington State face the problems created by this structural gap.

Effect of the structural gap

|

Find out more about the structural gap and factors creating the budget shortfall |

After the cap on property taxes was put in place, King County revenues grew by 2-3 percent a year, buoyed by the region’s construction boom. However, the rising cost of providing the same level of public services went up by 4 to 6 percent a year. The structural gap was worsened by the global recession of 2008-10. In the past several years, the County has been able to contain growth in costs to about 3.5 percent a year through various cost saving measures.

The projected deficit, or difference between revenues and costs, has forced King County to cut a few hundred million dollars in services during the past decade. The deficit for the 2019-2020 biennium is approximately $25 million. Such deficits have to be addressed by the County Executive when he presents a balanced budget, as required by law, for review and approval by the County Council.

How can the budget deficit be eliminated?

In the short term, the County has to make difficult decisions to balance its budget, as counties are required by law to adopt a balanced budget. In the long term, this structural gap between revenues and costs of county services can be resolved only through the collaboration of the State Legislature, counties, and voters.

Contact the Council |

|

| Main phone: 206-477-1000 |

|

| TTY/TDD: Relay: 711 |

|

| Find my Councilmember Click Here |

|

Translate

Translate