Benefit Access Fees

What is a Benefit Access Fee?

The Benefit Access Fee is a monthly payroll deduction that helps offset the cost of providing medical plan coverage to our employees' spouses and domestic partners. The amount depends on your employee benefit group, as detailed below. There are no Benefit Access Fees for covering children on your medical plan and Benefit Access Fees do not apply to dental and vision coverage.

Who pays a Benefit Access Fee?

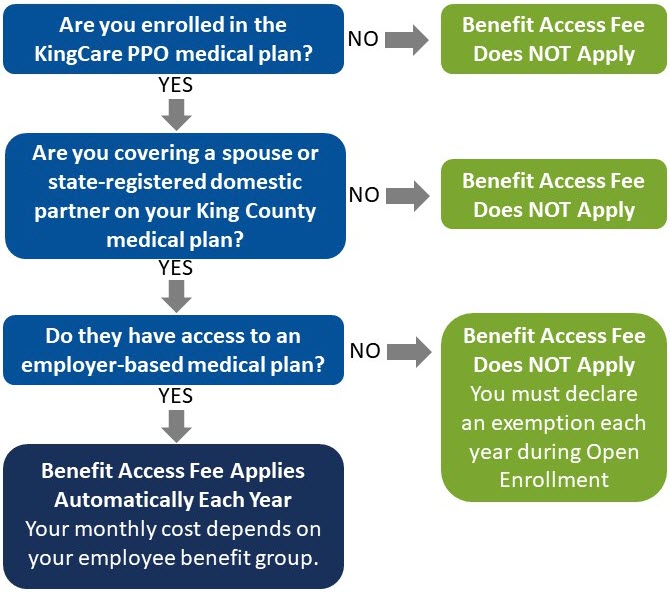

If you cover your spouse or domestic partner on your King County medical plan, and you enroll in the Regence KingCare PPO medical plan, you will pay a monthly Benefit Access Fee for your spouse/domestic partner’s coverage. The Benefit Access Fee will automatically apply each year you cover your spouse/partner. To determine if you will pay a Benefit Access Fee, use the following chart:

How much is the Benefit Access Fee?

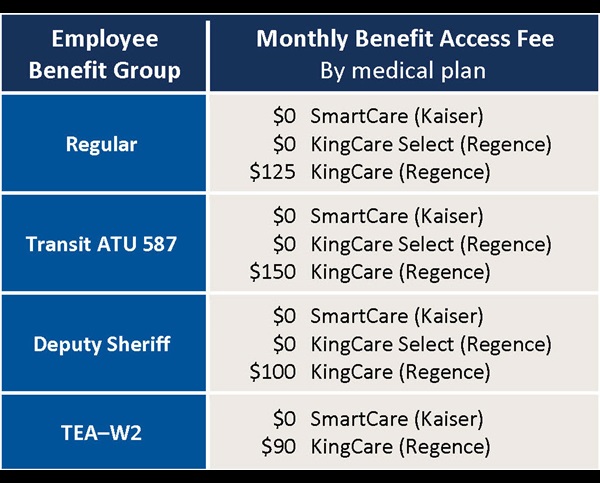

If you cover your spouse/domestic partner on your King County medical plan, and you enroll in the KingCare PPO medical plan, the Benefit Access Fee will automatically apply each year. The monthly amount depends on your employee benefit group, as follows:

Exemptions to the Benefit Access Fee

If you cover your spouse/domestic partner on your King County medical plan, and you enroll in the KingCare PPO medical plan, you may be eligible for one of the following exemptions to the Benefit Access Fee:

- Your spouse/domestic partner does not have access to medical coverage through their own employer.

- Your spouse/domestic partner is a King County benefits-eligible employee.

If you qualify for an exemption to the Benefit Access Fee, you must declare the exemption each year during Open Enrollment, Nov. 1–15. Benefit Access Fees are applied automatically every year to all employees who cover a spouse/partner on the KingCare PPO medical plan.

If you notify the Benefits team after Open Enrollment that you qualify for an exemption and would like to discontinue the Benefit Access Fee, that change will be made going forward, but fees already deducted will not be refunded.

Benefits and retirement

Payroll

Fax: 206-296-7678

Translate

Translate