2023 taxes

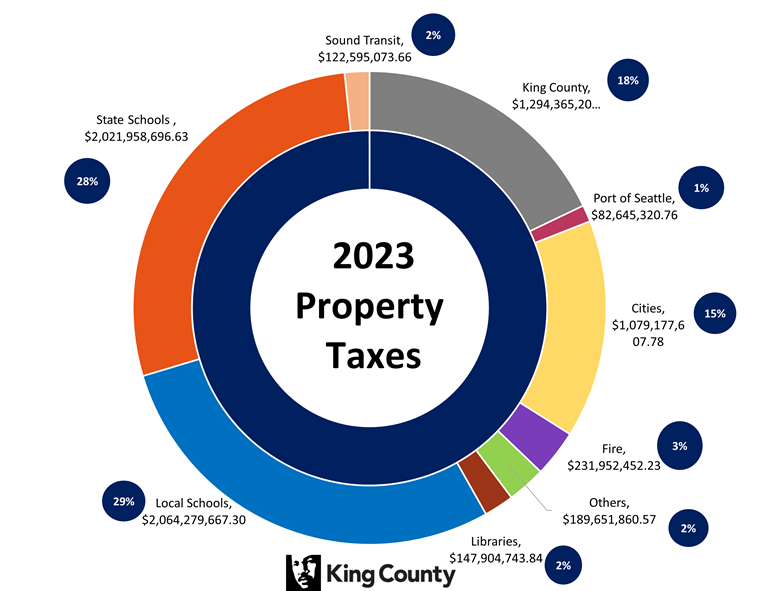

Where do my property tax dollars go?

We collect taxes for the state, the county, cities, and taxing districts like schools. Then we distribute the revenue back to them. Taxes also fund voter-approved measures for veterans, seniors, fire protection, and parks.

King County gets about 17% of your tax to fund services like roads, police, and public health.

Here's how it breaks down:

Property tax measures passed in 2022 for the 2023 tax year

Voters approved these lid lifts, levies, and bonds.

Qualifying seniors and disabled taxpayers are exempt from lid lifts.

King County

- A Conservation Futures 1-year permanent lid lift to a top rate of $0.06250/$1,000. It will help fund acquiring and preservation of:

- Urban green spaces

- Wildlife and salmon habitat

- Trails and river corridors

- Farm and forest lands

Cities

- Bellevue: 9-year temporary lid lift for open space and parks.

- Mercer Island: 16-year temporary lid lift for park maintenance and operations.

- Normandy Park: 6-year temporary lid lift for city services and police.

- Shoreline: 6-year permanent lid lift for police and neighborhood services.

Fire Districts

- FD 28: 6-year permanent lid lift restoration to $1.50/$1,000, with a 6% limit factor in years 2 to 6.

- FD 34: 6-year permanent lid lift to $1.25/$1,000, with a 6% limit factor in years 2 to 6.

- FD 44: 6-year permanent levy lid lift to $1.50/$1,000, with a CPI-W limit factor in years 2 to 6.

- Si View Metropolitan Park: 30-year general obligation bond used to fund an aquatic center.

School districts

School measures passed in 2022:

| Area | City | Type | Benefit | Term | Amount |

| 001 | Seattle | Special Levy | Educational Programs/Operations |

3-year | $646,800,000 |

| 001 | Seattle | Special Levy | Technology/Capital Projects | 6-year | $783,000,000 |

| 210 | Federal Way | Special Levy | Technology/Capitol Projects | 4-year | $174,000,000 |

| 210 | Federal Way | Special Levy |

Technology/Capital Projects | 6-year | $28,000,000 |

| 216 | Enumclaw | Special Levy | Educational Programs/Operations | 4-year | $52,341,704 |

| 400 | Mercer Island | Special Levy |

Educational Programs/Operations | 4-year | $48,000,000 |

| 400 | Mercer Island | Special Levy | Capital Projects | 6-year | $48,554,873 |

| 401 | Highline | Special Levy |

Educational Programs/Operations | 4-year | $268,030,800 |

| 401 | Highline | Bonds | Capital Improvements | 21-year | $518,397,000 |

| 402 | Vashon Island | Special Levy |

Educational Programs/Operations | 4-year | $24,983,305 |

| 403 | Renton | Special Levy | Educational Programs/Operations | 4-year | $170,497,780 |

| 403 | Renton | Special Levy |

Capital Improvements | 4-year | $120,000,000 |

| 404 | Skykomish | Special Levy | Maintenance & Operations | 4-year | $586,383 |

| 405 | Bellevue | Special Levy |

Technology/Capital Projects | 4-year | $308,000,000 |

| 405 | Bellevue | Special Levy | Educational Programs/Operations | 4-year | $228,000,000 |

| 407 | Riverview | Special Levy |

Educational Programs/Operations | 4-year | $37,346,968 |

| 410 | Riverview | Special Levy | Technology Levy | 4-year | $15,200,000 |

| 410 | Snoqualmie Valley | Special Levy |

Educational Programs/Operations | 4-year | $87,912,000 |

| 411 | Snoqualmie Valley | Special Levy | Technology Levy | 4-year | $35,693,000 |

| 411 | Issaquah | Special Levy |

Transportation/School Bus | 1-year | $3,000,000 |

| 411 | Issaquah | Special Levy | Educational Programs/Operations | 4-year | $262,000,000 |

| 411 | Issaquah | Special Levy |

Capital Projects | 4-year | $141,310,000 |

| 412 | Shoreline | Special Levy | Educational Programs/Operations | 4-year | $108,750,000 |

| 412 | Shoreline | Special Levy |

Capital Projects/Technology | 4-year | $14,000,000 |

| 414 | Lake Washington | Special Levy | Educational Programs/Operations | 4-year | $369,000,000 |

| 414 | Lake Washington | Special Levy |

Capital Projects/Technology | 4-year | $177,100,000 |

| 414 | Lake Washington | Special Levy | Capital Levy | 6-year | $295,000,000 |

| 417 | Northshore | Special Levy |

Educational Programs/Operations | 4-year | $265,100,000 |

| 417 | Northshore | Special Levy | Technology Levy | 4-year | $80,000,000 |

| 888 | Fife | Special Levy |

M&O Levy | 4-year | $45,213,000 |

| 888 | Fife | Special Levy | Capital Projects/Technology | 5-year | $14,000,000 |

2022 commercial area reports

Related tasks

Your property taxes

We base the property taxes you pay this year on the value of your property as of January 1 the previous year. For example, in February of 2023, you received a tax bill for the value of your property as calculated on January 1, 2022. For remodels or new structures, we assess values on July 31 of each year.

By the numbers

- Total county property values increased in 2022 to $722.5 billion from $659.5 billion, or 21.8%.

- Property taxes for the year rose from $6.6 billion to $7.2 billion, or 6.4%.

Why do my property taxes increase?

Your property taxes will vary depending on several factors:

- Location

- The assessed value of the property

- How many jurisdictions (state, county, city, school or fire district, etc.) levy taxes

See Property tax bills and residential median values by city.

Why is there a difference between increases in your property value and your property tax?

The state of Washington uses a "budget-based" property tax system. Mill or levy rates adjust to property value changes. Only the amount of revenue requested by taxing districts is generated. The mill rate goes down when values go up, and up when values go down).

State law limits the revenue taxing districts like cities and school districts can collect from year to year. It can only increase by 1% unless voters approve more. Voter-approved levies are usually why your property taxes go up. They're not subject to the 1% growth restriction.

Here are examples of how the budget-based system works:

- The highest 2022 property value increase was in Sammamish, where median home values increased 51.2%. Because of the “budget based” system, the property tax increase for 2023 payments in Sammamish is 24.0%. To accomplish this, the levy rate for Sammamish decreased by -18%, or -$1.72935 per $1,000 of property value.

- Tukwila had the lowest property tax increase for 2023, with a 1.3% increase. The median home value increased 16.7% in 2022. So the levy rate decreased -13.2%, or -$1.59891 per $1,000 of property value.

Translate

Translate